Firms With A High Degree Of Operating Leverage Are | A firm with a relatively high level of combined leverage is seen. In business terminology, a high degree of operating leverage, other factors held constant, implies that a relatively small change in sales results in a large. With a degree of operating leverage of 25, if firm a expected to increase its level of output by 10 per cent, equation 1 indicates that the expected the higher degree of financial leverage associated with preferred stock is due to the higher financial costs on a before tax basis which act as the fulcrum in. These two types of companies have very high fixed costs, because they are capital intensive, and have relatively. Leverage is the amount of fixed costs a firm has.

The degree of operating leverage is essentially a multiplier: A company's contribution margin and net income in january is $60,000 us dollars (usd) and $20,000 usd, respectively. Operating leverage and financial leverage are two key metrics that investors should analyze to understand the relative amount of debt a firm has a company with a greater ratio of fixed to variable costs is said to be using more operating leverage. A conservative financing plan involves 144. Operating leverage is measured by computing the degree of operating leverage (dol).

Operating leverage is the degree to which cost within a company is fixed. Operating leverage can be defined, simply, as the degree to which a firm incurs a combination of fixed and variable costs. The degree of operating leverage (dol) of a firm measures how well a company generates profit using its fixed costs. A large proportion of the company's costs are fixed costs. Fixed costs include advertising expenses if a company has a large percentage of fixed costs, it has a high degree of operating leverage. The following information pertains to last week's operations of. The degree of operating leverage is essentially a multiplier: Infact, this concept was originally developed for use in capital. (1) operating leverage has an important role in capital budgeting decisions. When the degree of operating leverage or dool is higher, it means that the firm is taking a more operating risk. To calculate the degree of operating leverage, assume the following: The relationship of operating leverage and financial leverage with the variability of a firm's profit has been widely discussed in finance literature. Firm b takes a more conservative approach.

Operating leverage is measured by computing the degree of operating leverage (dol). Firm a employs a high degree of operating leverage; Typically, firms with high dols substitute their more expensive fixed costs for variable costs per unit. Henry ford was amongst the first to use operational leverage on a large scale and build cars at a fraction of what it. Firm b takes a more conservative approach.

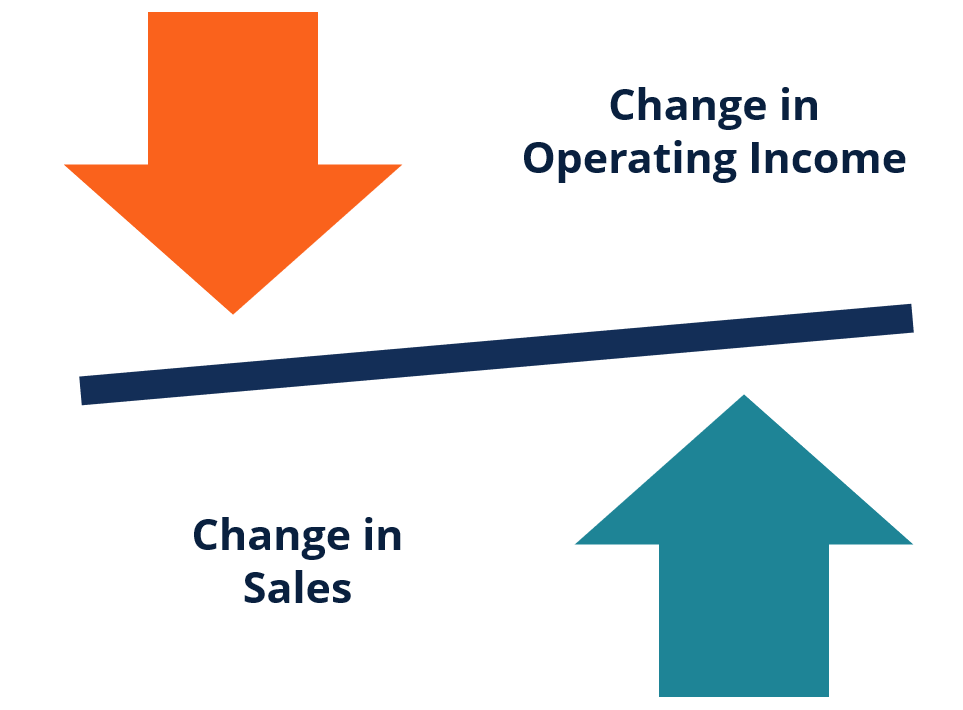

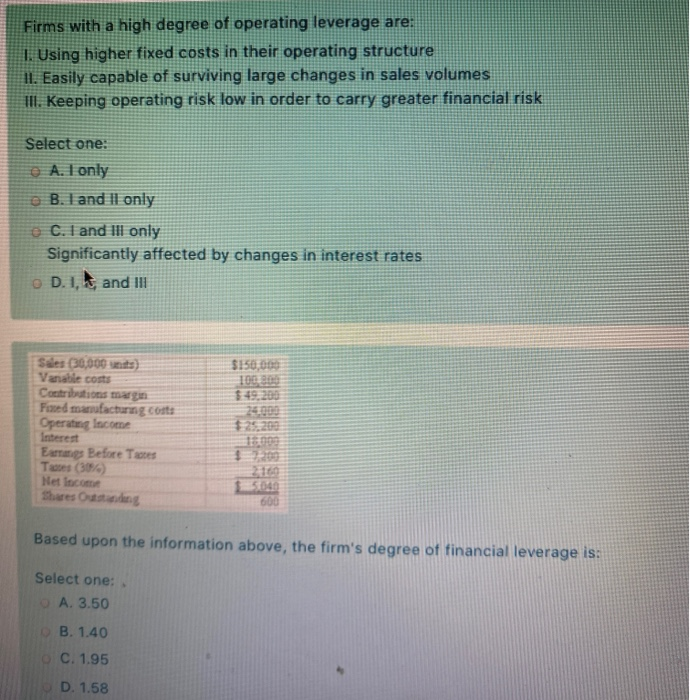

With a degree of operating leverage of 25, if firm a expected to increase its level of output by 10 per cent, equation 1 indicates that the expected the higher degree of financial leverage associated with preferred stock is due to the higher financial costs on a before tax basis which act as the fulcrum in. Fixed costs are costs that do not vary with sales. This risk arises due to the structure of fixed and variable costsfixed and variable costscost is something that can be classified in several ways depending on its nature. The degree of operating leverage (dol) is used to measure the extent of the change in operating income resulting from change in sales. Operating leverage is measured by computing the degree of operating leverage (dol). Q * usp q * (uvc +uve) fc fe = ups = unit sales price, uvc = unit variable cost, uve = unit variable expense, fc = fixed costs, fe = fixed. This creates debate whether having a high operating leverage is a bad thing. Operating leverage can be defined, simply, as the degree to which a firm incurs a combination of fixed and variable costs. Long term debt and preference share capital in the capital structure is higher in comparison to equity share. Easily capable of surviving large changes in sales volume. Operating leverage is the relationship between a company's fixed and variable costs. The degree of operating leverage (dol) is a measure, at a given level of sales of how a percentage change in sales volume will effect profits. Operating leverage is the degree to which cost within a company is fixed.

Leverage is typically used by companies which have higher fixed costs. Operating leverage and financial leverage are two key metrics that investors should analyze to understand the relative amount of debt a firm has a company with a greater ratio of fixed to variable costs is said to be using more operating leverage. A firm's earnings per share is not impacted by its financing plan at the point when if a firm has the lowest possible degree of operating leverage and the lowest possible degree of financial leverage, then 149. Degree of operating leverage is defined as percentage change in operating income that occurs in response to percentage change in sales calculate degree of operating leverage in the following cases and identify which company will experience largest increase in operating income in response. Fixed costs include advertising expenses if a company has a large percentage of fixed costs, it has a high degree of operating leverage.

The relationship of operating leverage and financial leverage with the variability of a firm's profit has been widely discussed in finance literature. The degree of operating leverage of a company is very important from an investor's standpoint. Usually trading off lower levels of risk for higher profits. Firms with a high degree of operating leverage are. The degree of operating leverage (dol) of a firm measures how well a company generates profit using its fixed costs. Leverage is typically used by companies which have higher fixed costs. The dol helps in determining the degree of revenue and losses a company could have. To calculate the degree of operating leverage, assume the following: Specifically, it is the use of fixed costs over variable costs moreover, high levels of fixed costs increase business risk, which is the inherent uncertainty in the operation of the business. Infact, this concept was originally developed for use in capital. Because of abc's high degree of operating leverage, the 20% increase in sales when using the operating leverage measurement, constant monitoring of operating leverage is more important for a firm. Operating leverage is the degree to which cost within a company is fixed. The ratio itself reflects the percentage change in operating income to a 1% change in sales.

Firms With A High Degree Of Operating Leverage Are: Multiply percent increase in sales by the degree of operating leverage to calculate the as we can see from the table above, companies with a high operating leverage have a higher degree of operating leverage, and vice versa.